41+ deduct mortgage interest rental property

Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Home is a 3 bed 20 bath property.

Buy To Let Tax Relief Moneysupermarket

This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

. Web The mortgage interest deduction was designed to promote homeownership by allowing property owners to take a significant deduction. Web Mortgage interest and property taxes. Web It is important to note that for the mortgage interest deducted on Schedule A you are only allowed an itemized deduction for your main house and ONE additional.

Repair costs utility bills. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. Web ii property submitted to the provisions of this article on which any building or buildings or any portion thereof has been rented to any tenant or tenants.

Mortgage interest on a loan used to buy or improve the property and property taxes are deductible as rental expenses. Web 633 Winsor St Jamestown NY 14701-3437 is a single-family home listed for-sale at 79900. Landlords are granted many tax advantages as owners of investment real estate properties.

Home is a 3 bed 20 bath property. Web Deductible real property taxes include any state or local taxes based on the value of the real property and levied for the general public welfare. You should have entered the property as an Asset to be.

Deductible real property taxes. Web Deduction of Mortgage Interest on Rental Property. Web These expenses relate to a number of business-related activities that include buying operating and maintaining the property that all add up to make it a thriving rental.

Web We can deduct at least interest on 100000 as primary residence address and we get to deduct the rest on the rental or we can make an election to deduct it all. Web 37 Linwood Ave Jamestown NY 14701-8309 is a single-family home listed for-sale at 94000. Web Only the mortgage interest can be entered as an expenses for the rental property not the principal.

Mortgage Interest Tax Deduction What You Need To Know

Classic Properties International Volume Ii Number 3 John L Scott Real Estate By Real Property Marketing Group Ltd Issuu

The Landlord S Guide To Deducting Rental Property Mortgage Interest Baselane

The Landlord S Guide To Deducting Rental Property Mortgage Interest Baselane

How Much Mortgage Interest Is Tax Deductible Section 24 Tenant Tax

41 Rancho Escondido Santa Fe Nm 87506 Realtor Com

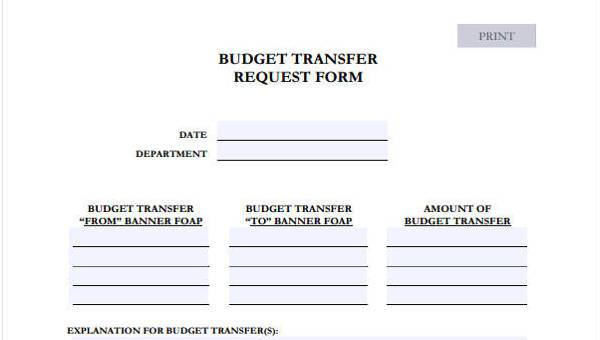

Free 41 Budget Forms In Pdf

Intouchjan Feb2016 By Into Issuu

:max_bytes(150000):strip_icc()/house-keys-and-contract-on-table-in-house-rental-1082558850-f4ceefa00b2f4b08b84c4ae77d17dd65.jpg)

The Tax Benefits Of Owning A Rental Property

285 Hustler 120122 By Colorado Community Media Issuu

Is Your Mortgage Considered An Expense For Rental Property

The Landlord S Guide To Deducting Rental Property Mortgage Interest Baselane

Can You Claim Rental Mortgage Interest As An Itemized Deduction

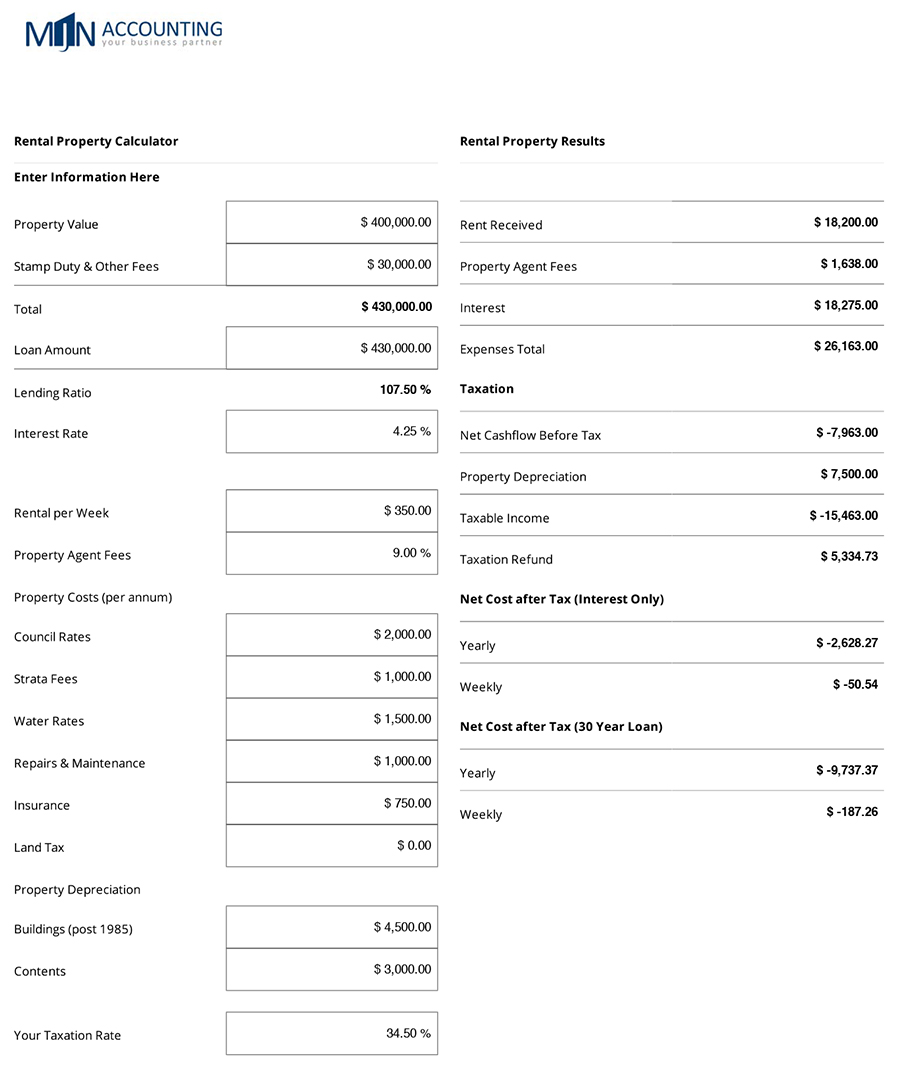

Bk Partners Your Chartered Accountant How Much Does It Really Cost To Own A Rental Property And Is It For Me

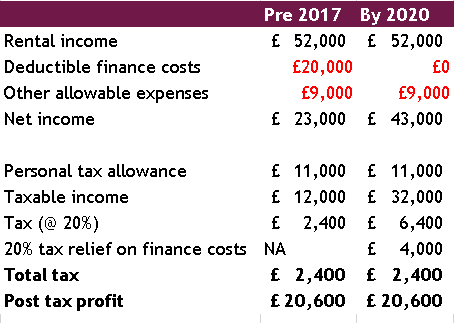

Landlord Tax Changes Come Into Effect April 2017

Mortgage Broker Greensborough Diamond Creek Eltham Mortgage Choice

Interest On Buy To Let Mortgages Eoacc Uk